Life Sciences

+Life Sciences

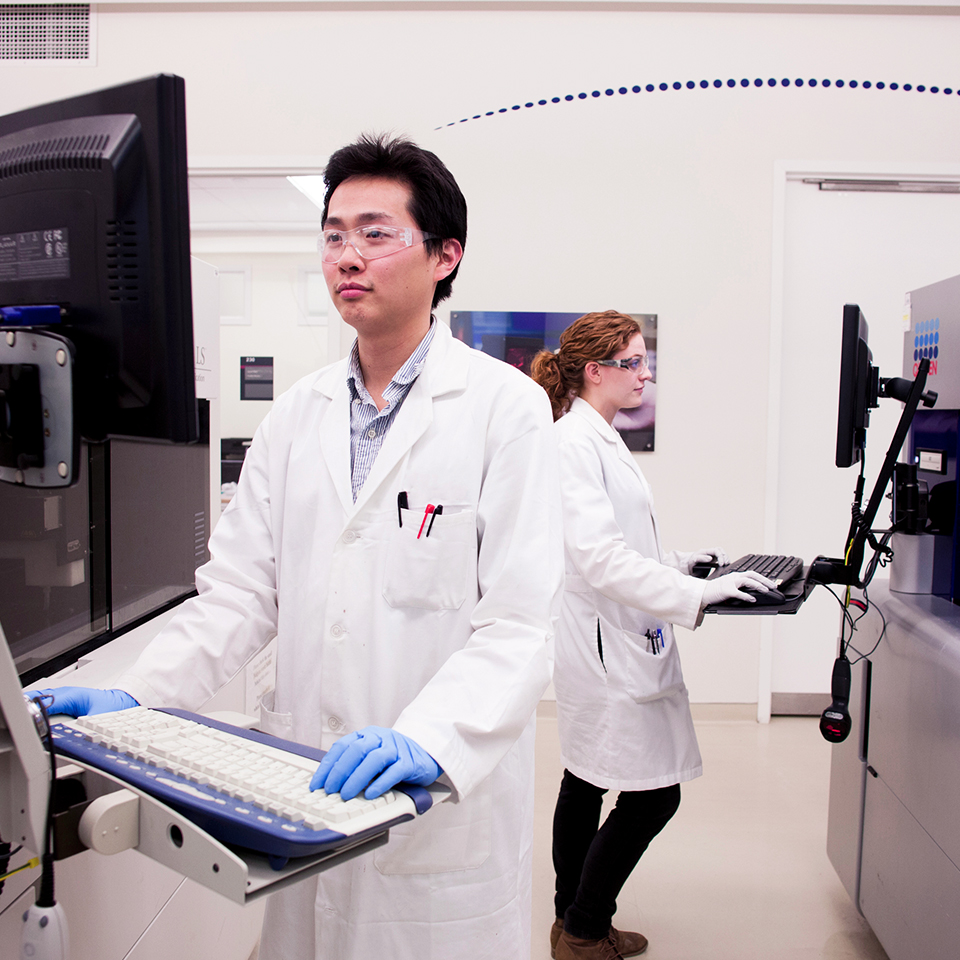

New Jersey is one of the world’s leading destinations for biopharmaceutical R&D, biopharmaceutical manufacturing, cell & gene therapy, and medical devices. In fact, eight of the top 10 largest pharmaceutical companies call New Jersey home. With a legacy of pioneering discoveries and a supportive ecosystem of academic institutions, research centers, and venture capital, New Jersey continues to drive life sciences advancements on a global scale.

Technology

+Technology

New Jersey’s emphasis on STEM education and its supportive startup ecosystem provides a launch pad for tech innovation. New Jersey-based tech companies are revolutionizing advancements in AI, fintech, esports, telecom, cybersecurity, and beyond. Supported by a skilled workforce, academia, and collaborative workspaces, global information technology companies like Audible, Verizon, and Samsung thrive in New Jersey.

Advanced Manufacturing

+Advanced Manufacturing

Advanced manufacturing in New Jersey represents a dynamic blend of innovation, precision, and industry expertise. New Jersey manufacturers produce everything from food and building materials to computers and electronics. Our advanced manufacturing sector is pioneering new supply chain solutions and fostering economic growth.

Food & Beverage

+Food & Beverage

New Jersey’s food and beverage industry is redefining what it means to produce and package food sustainably. The $126 billion food industry in the state has seen an increase of 6,000 jobs in the past five years, and more than ⅓ of the top 100 major food companies in the United States have a presence in the state, including industry giants like Campbell Soup Company. Leading food tech companies that specialize in plant-based substitutes, vertical farming, and more continue to push the boundaries of how the world thinks about, produces, and consumes food.

Financial Services

+Financial Services

Our strategic location and highly educated workforce create an environment where financial companies succeed. Within just minutes from Wall Street, New Jersey offers the connectivity and resources of the world’s financial capital at a much more affordable price than New York City. It’s no surprise that many of the world’s leading financial firms – including Prudential Financial, PNC Bank, and JP Morgan Chase – call New Jersey home.

Logistics

+Logistics

New Jersey is a crucial artery of commerce, connecting businesses to markets both domestically and internationally. New Jersey boasts a robust infrastructure — including The Port of New York and New Jersey, Newark Liberty International Airport, and the highest railroad density in the nation — that allows companies to move goods fast. With the rising demand for next-day and same-day delivery through e-commerce, New Jersey has the resources and infrastructure necessary to keep up with the increase in shipping volume required to get packages where they need to go quickly.

Clean Energy

+Clean Energy

New Jersey’s clean energy industry is at the forefront of sustainable innovation, making way for a greener future. The New Jersey Wind Port is the first port in the United States dedicated to Offshore Wind. The state is positioned to be a leader in offshore wind with its 130 miles of coastline, 340,000 acres of land with close proximity to shore, shallow water depths, and strong wind speeds. The State has implemented progressive policies, incentivizing the development of green technologies and committing to a more resilient energy infrastructure.

Film, TV, & Digital Media

+Film, TV, & Digital Media

New Jersey offers one of the nation’s most attractive incentive programs for filmmakers, featuring a 30% or 35% tax credit and a 2% or 4% diversity bonus. Here, you will find a pro-film environment with cooperative counties and municipalities and a breathtaking variety of locations and landscapes. The New York-New Jersey metro area has the highest concentration of creative and technical professionals outside of California, including a strong network of support services and vendors.

Translate

Translate Arabic

Arabic Chinese (Simplified)

Chinese (Simplified) Dutch

Dutch English

English French

French German

German Italian

Italian Portuguese

Portuguese Russian

Russian Spanish

Spanish