GDP & Workforce

New Jersey received seven credit upgrades over the past two years and ranked #1 in the Northeast for private-sector job growth in 2022. Our economic growth is supported by our highly-educated talent and skilled workforce

Stay up to date on New Jersey’s business landscape! Subscribe to our newsletter to receive updates, insights, and highlights directly to your inbox.

New Jersey’s world-class workforce, infrastructure, and ample State support make it the best place in North America for business relocation or expansion.

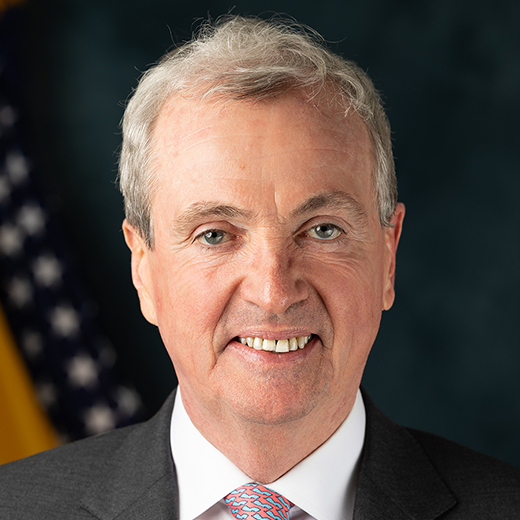

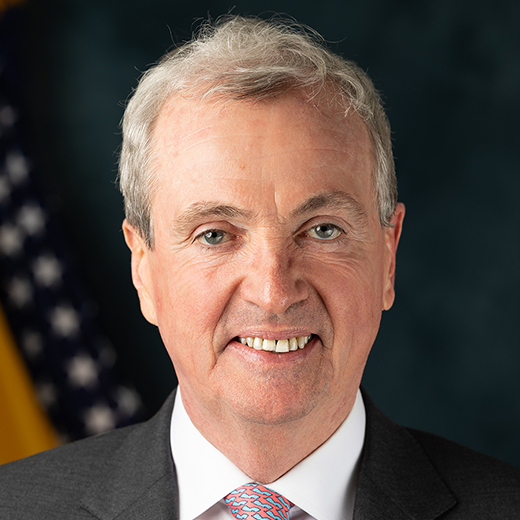

In 2023, CNBC named New Jersey the Most Improved State for Business in the country. Since June 2020, New Jersey has ranked first among Northeast states for private sector job creation, and personal income has grown across the State by over 5%. With Governor Phil Murphy’s continued investment and focus on our key sectors, and support of our small businesses, New Jersey’s brightest days lie ahead.

The New Jersey Economic Development Authority (NJEDA) plays a vital role in cultivating economic prosperity and bolstering enterprise throughout New Jersey. Committed to spurring innovation and job creation, NJEDA provides more than 50 tax credits, grants, and bespoke incentives for businesses ready to create jobs, invest in local communities, or innovate in key sectors like technology, clean energy, and film, for which we boast the best tax incentives in the country. NJEDA also enacted the Economic Recovery Act, which creates a seven-year, $14 billion package of tax incentives, financing, and grant programs that address the economic impacts of the COVID-19 pandemic to build a stronger, fairer New Jersey economy.

New Jersey is committed to building tomorrow’s infrastructure today. From interconnected transportation networks to reliable utilities, our State is on the move, investing in infrastructure projects that pave the way for seamless connectivity and economic development. The Gateway Program will deliver critical rail infrastructure projects between Newark (a key hub for NJ Transit and Amtrak) and Penn Station in New York City, as well as create a new tunnel under the Hudson River and replace several bridges over the next several years. Infrastructure is also being built to support high-growth industries, like the New Jersey Wind Port, located on the Eastern shore of the Delaware River in Lower Alloways Creek. It is the nation’s first purpose-built offshore wind port and provides essential staging, assembly, and manufacturing activities related to offshore wind projects on the East Coast.

To meet the needs of businesses and industries, New Jersey is committed to cultivating a workforce that’s ready for tomorrow’s challenges. Through innovative partnerships bridging businesses, academia, and government, we are creating training programs, apprenticeships, and educational pathways tailored to the specific needs of evolving industries. This collaborative approach ensures that our talent pool is finely tuned to the demands of the market, offering companies a competitive edge through a skilled and adaptable workforce.

These programs include:

Small businesses are the backbone of our community and the engine of our growth. Recognizing their crucial role, New Jersey is committed to providing an ecosystem where small and diverse businesses flourish. Since 2018, the amount of New Jersey small businesses has increased by over 40,000, a nearly 20% increase. The 2024 state budget provided a fourth consecutive investment of $50 million in small businesses.

Source: Moody’s, Standard & Poor’s, Fitch

Source: Bureau of Labor Statistics 2022

Source: NJEDA

Source: CNBC, 2023

U.S. News & World Report

Source: National Science Board

Source: Port Authority of NY and NJ

Source: Innerbody Research

Source: Pharmaceutical Executive, 2021

New Jersey’s key industries are the foundation of our economic strength. The State is actively investing in and cultivating these industries, providing them with the workforce, financial support, and development space they need to thrive.

New Jersey is one of the world’s leading destinations for biopharmaceutical R&D, biopharmaceutical manufacturing, cell & gene therapy, and medical devices. In fact, eight of the top 10 largest pharmaceutical companies call New Jersey home. With a legacy of pioneering discoveries and a supportive ecosystem of academic institutions, research centers, and venture capital, New Jersey continues to drive life sciences advancements on a global scale.

New Jersey’s emphasis on STEM education and its supportive startup ecosystem provides a launch pad for tech innovation. New Jersey-based tech companies are revolutionizing advancements in AI, fintech, esports, telecom, cybersecurity, and beyond. Supported by a skilled workforce, academia, and collaborative workspaces, global information technology companies like Audible, Verizon, and Samsung thrive in New Jersey.

Advanced manufacturing in New Jersey represents a dynamic blend of innovation, precision, and industry expertise. New Jersey manufacturers produce everything from food and building materials to computers and electronics. Our advanced manufacturing sector is pioneering new supply chain solutions and fostering economic growth.

New Jersey’s food and beverage industry is redefining what it means to produce and package food sustainably. The $126 billion food industry in the state has seen an increase of 6,000 jobs in the past five years, and more than ⅓ of the top 100 major food companies in the United States have a presence in the state, including industry giants like Campbell Soup Company. Leading food tech companies that specialize in plant-based substitutes, vertical farming, and more continue to push the boundaries of how the world thinks about, produces, and consumes food.

Our strategic location and highly educated workforce create an environment where financial companies succeed. Within just minutes from Wall Street, New Jersey offers the connectivity and resources of the world’s financial capital at a much more affordable price than New York City. It’s no surprise that many of the world’s leading financial firms – including Prudential Financial, PNC Bank, and JP Morgan Chase – call New Jersey home.

New Jersey is a crucial artery of commerce, connecting businesses to markets both domestically and internationally. New Jersey boasts a robust infrastructure — including The Port of New York and New Jersey, Newark Liberty International Airport, and the highest railroad density in the nation — that allows companies to move goods fast. With the rising demand for next-day and same-day delivery through e-commerce, New Jersey has the resources and infrastructure necessary to keep up with the increase in shipping volume required to get packages where they need to go quickly.

New Jersey’s clean energy industry is at the forefront of sustainable innovation, making way for a greener future. The New Jersey Wind Port is the first port in the United States dedicated to Offshore Wind. The state is positioned to be a leader in offshore wind with its 130 miles of coastline, 340,000 acres of land with close proximity to shore, shallow water depths, and strong wind speeds. The State has implemented progressive policies, incentivizing the development of green technologies and committing to a more resilient energy infrastructure.

New Jersey offers one of the nation’s most attractive incentive programs for filmmakers, featuring a 30% or 35% tax credit and a 2% or 4% diversity bonus. Here, you will find a pro-film environment with cooperative counties and municipalities and a breathtaking variety of locations and landscapes. The New York-New Jersey metro area has the highest concentration of creative and technical professionals outside of California, including a strong network of support services and vendors.

New Jersey received seven credit upgrades over the past two years and ranked #1 in the Northeast for private-sector job growth in 2022. Our economic growth is supported by our highly-educated talent and skilled workforce

The population of New Jersey on July 1, 2023

Source: U.S. Census, July 2023

Unemployment, February 2024

Source: Source: Bureau of Labor Statistics, March 2024

Current-Dollar Gross Domestic Product, Q3 2023

Source: U.S. Bureau of Economic Analysis, Q3 2023

of U.S. GDP, Q3 2023

Source: U.S. Bureau of Economic Analysis, Q3 2023

Labor Force February, 2024

Source: Bureau of Labor Statistics, March 2024

Median Personal Income, 2023

Source: U.S. Bureau of Economic Analysis, 2023

New Jersey offers businesses a comprehensive basket of goods to help them thrive – from State grants and loans to a world-leading infrastructure that’s constantly being improved. State taxes go to support these programs, the best public school system in the nation, and help ensure a high quality of life for residents.

6.5% for income > $0

7.5% for income > $50,000

9.0% for income > $100,000

11.5% for income > $10,000,000

None

6.625% State Tax

None

1.4%-10.75% (For Incomes above $1,000,000)

None

Property taxes are assessed by local governments. The average property tax rate in NJ is 2.49%.

41.40 cents per gallon of gasoline

New Jersey welcomes all cultures with open arms. Just look at the Statue of Liberty – the quintessential symbol of freedom that sits directly in New Jersey waters. Our history is deeply rooted in immigration, creating a society that is diverse and dynamic. People of all ethnicities, religions, and cultures call New Jersey home.

23% Foreign Born Population

New Jersey is proud to have the second-highest concentration of foreign-born residents (23%). Immigrants feel right at home in New Jersey’s many diverse communities. The State is the #1 ranked U.S. state for foreign language education. Universities like New Jersey Institute of Technology have a stellar reputation for educating first-generation college graduates, positioning them for success.

White

Hispanic (of All Races)

Black or African American

Asian

Other

Two or More Race

American Indian and Alaska Native

Source: Jobs EQ using American Community Survey, 2017-2021

1. India

2. Dominican Republic

3. Mexico

4. China

5. Ecuador

6. Colombia

7. Phillipines

8. Korea

9. Peru

10. Brazil

Source: Office of Research and Information, Labor Market Spotlight, December 2023

New Jersey boasts one of the most highly skilled and educated workforces in the nation. The proportion of New Jersey residents with a bachelor’s degree or higher is significantly above the national average — 44% compared to the United States’ 34%. With such a rich, diverse talent pool, New Jersey is an unmatched destination for businesses.

High School Graduate or Higher

New Jersey Percentage

High School Graduate or Higher

U.S. Percentage

Bachelor’s or Higher

New Jersey Percentage

Bachelor’s or Higher

U.S. Percentage

Graduate or Professional Degree

New Jersey Percentage

Graduate or Professional Degree

U.S. Percentage